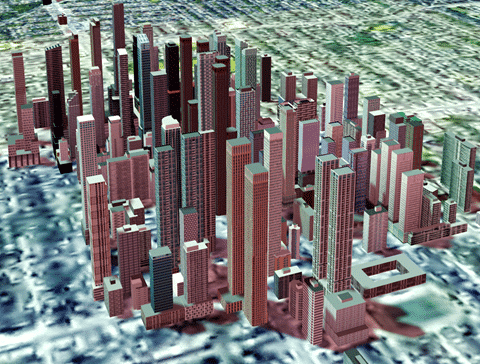

New Condos Toronto

Welcome to the ultimate resource for finding pre-construction condos in Toronto! As Ontario’s bustling metropolis, Toronto combines urban sophistication with diverse cultural experiences. Whether you’re looking for the latest pre-construction condos in Toronto or move-in-ready new condos in Toronto, you’ve come to the right place. Explore our extensive listings of new condos for sale in Toronto. Learn why Toronto is the top choice for your next investment or dream condo today!

Real Estate Market Trends of Toronto 2025

As of Oct 2025, the average price per square foot for pre-construction condos in Toronto ranges from approximately $1,000 to $1,500, with higher prices downtown and lower prices in suburban areas. According to recent data:

- Pre-Construction Condo Prices (per sq ft):

- Downtown: $1,500 per sq ft

- Suburbs: $1,000 per sq ft

- New Condominium Average Selling Price: ~$1,100

- Average Selling Price for All Homes (Combined): ~$1,089,918

- Condo Apartment Rental Rates:

- Bachelor: $1,886/month

- 1-Bedroom: $2,368/month

- 2-Bedroom: $3,210/month

- Overall average: $2,450/month

- Vacancy Rate for Condominium Apartments: 1% – 1.5 %

- Average Days on Market:

- New Condo Developments: ~64 months to sell out current inventory

- Detached Homes (Resale): ~21 days

- Townhouses (Resale): ~25 days

- Condo Apartments (Resale): ~30 days

List of Pre-Construction Condos & Homes in Toronto

What Are Pre-Construction Condos and Homes?

“Pre-construction” refers to properties that are sold before they are built or while under construction. Instead of buying a finished home, you’re typically purchasing from floor plans and renderings, then waiting for the building to be completed. In Toronto, this is a popular route to get a brand-new home – and it’s not limited to just high-rise condos.

Pre-construction condos are the most common, usually in mid-rise or high-rise buildings where each unit is individually owned. However, you can also buy pre-construction homes in other forms, including townhouses, stacked townhomes, semi-detached and even detached houses in emerging communities. Explore the different types of townhouses in Toronto to see what best fits your needs. For example, many new master-planned communities in the GTA offer a mix of condo apartments and townhomes. Each property type has its nuances – from condo maintenance fees to the land ownership of a freehold townhouse.

In essence, buying pre-construction means locking in a property at today’s price and paying for it in stages while it’s being built. You’ll usually put down a series of deposits (a total of 10–20% of the price, spread out over a year or more), and the remainder is due at closing when the home is finished. The appeal is that you get a brand new, never-lived-in home – often with a say in the finishes and layouts – and you have time to plan your move and finances. But who exactly is this kind of purchase best suited for? Let’s explore a few profiles from my experience.

Who Is a Pre-Construction Condo Investment For?

Is buying pre-construction right for you? Over the years, I’ve helped a variety of clients secure pre-construction deals, and I’ve noticed a few common “profiles” of buyers who thrive with this strategy. Here are a few fictionalized stories (based on real scenarios) to illustrate who can benefit most from a pre-construction condo investment:

If you fit one of these profiles or have similar long-term goals, pre-construction might be an ideal path for you (check out our guide on [who the ideal pre-construction condo buyer is] for more insight on buyer profiles)

Type of Pre-Construction Condos & Homes Buyers - Which one is You?

Savvy First-Time Buyer – “Future Planner”

Meet Alice, a 28-year-old first-time buyer. Alice doesn’t need a home immediately – she’s currently renting – but she wants to get on the property ladder. With a pre-construction condo, she was able to secure The Bedford Condos at a fixed price today, with a 2027 completion. The staggered deposit structure gave her time to save up gradually. By the time the condo is ready, Alice will have built more equity (the condo’s market value may have risen by then) and she’ll move into a brand-new unit she watched come to life. For future planners like Alice, buying pre-construction is a way to secure a home for tomorrow while you organize your finances today.

Investor Landlord – “Equity Builder”

Brian is an investor in his mid-40s who’s bought several pre-construction condos with me. His latest purchase was a two-bedroom pre-construction condo in Midtown Toronto, aimed for completion in 4 years. Brian’s strategy is to rent it out upon completion. Why pre-construction? He locks in the price now and banks on the condo’s value appreciating by completion. Plus, he can carefully choose a unit with optimal layout and low maintenance fees for better rental yield. I helped Brian get Platinum VIP access to the project, so he got one of the first picks of units (a corner suite with great city views). Investors like Brian love that pre-construction condos come with a new home warranty and brand-new appliances – meaning lower maintenance costs in the first few years. (Whether you’re buying to live in or to invest, your approach will differ – from unit type to location and timeline.📘 Learn how to approach pre-construction for investment vs. personal use →

Downsizers – “Lifestyle Seekers”

Catherine and John, a couple in their 60s, decided to downsize from their suburban house. They aren’t in a rush, so a pre-construction home made sense to them for a 2026 move-in. We found them a boutique pre-construction condo near the Toronto waterfront. For Catherine and John, the appeal was designing their future home with the finishes they love, all on one floor (no more stairs!), and in a lively area where they can walk to cafes and the lake. They secured a wheelchair-accessible suite early in the sales phase to ensure their needs are met. Now they’re enjoying their current home while eagerly awaiting a hassle-free, custom-tailored condo that will suit their retirement lifestyle.

Growing Family – “Space Upgrader”

Deepak and Nina are a young couple expecting their second child. They own a one-bedroom resale condo and realize they’ll need more space in a couple of years. Instead of trying to time the market later, they bought a pre-construction townhome in Toronto’s East End. It’s a 3-bedroom unit slated to be ready in three years – just when their eldest is starting school. This way, they secured a larger home at a fixed price and can stay put in their current condo until the new home is built. The pre-construction townhome option gave them more space and a small yard, and by buying early, they had the chance to choose their interior color palettes and upgrades to make it family-friendly. For upgraders like Deepak and Nina, pre-construction provides a future family home without the pressure of moving kids immediately – and no need to renovate an older home because everything will be brand new.

Benefits of Investing in Pre-Construction Condos in Toronto

Buy at Today’s Prices, Reap Tomorrow’s Gains

Buying a pre-construction condo comes with some compelling advantages. As someone who has guided many clients through this journey, I can attest to these benefits not just in theory, but in real outcomes I’ve seen. Here are some key benefits of going pre-construction in Toronto:

When you buy pre-construction, you’re locking in the price now for a home that might not be finished until 3-5 years later. In a rising market, this can mean significant price appreciation by the time you take possession. For example, several of my clients who bought pre-construction condos in 2018-2019 saw their units worth substantially more upon completion. Essentially, your deposit is working like a down payment on future value. It’s a way to ride the wave of Toronto’s growth with a smaller upfront investment.

Extended Deposit Schedule = More Time to Save

Unlike a resale home (where 20% down payment is due within months), pre-construction deposits are broken into stages. Typically, you might pay 15% spread over a year or two (e.g. 5% in 30 days, 5% in 6 months, 5% in 1 year). This staggered schedule acts as a forced savings plan. My first-time buyer clients especially appreciate having a year or two to save up the full down payment while knowing a home is secured for them. If you’re unsure how this works, here’s a helpful guide on how deposit structures work in pre-construction. It makes homeownership attainable without the pressure of coming up with a huge sum all at once.

First Pick of Units and Customize Your Home

When you buy early in a development (especially with Platinum VIP access in pre-construction ), you get first choice of the best floor plans and views. Want a higher floor with unobstructed views or a specific layout? Pre-construction is your chance to snag it before anyone else. Plus, you often get to choose your interior finishes from the builder’s decor selections – things like cabinets, flooring, and paint colors – giving your home a personal touch from day one. I’ve found that clients really enjoy the design center process, selecting finishes that match their style (and not having to immediately renovate, as you might with an older resale unit)

Brand New Home Warranty and Lower Maintenance

A newly built condo comes with the Tarion new home warranty program in Ontario, which protects you against construction defects and major issues for up to 7 years. Everything is brand new – appliances, heating/cooling systems, windows – meaning you likely won’t face significant maintenance costs for a while. I’ve had investors choose pre-construction condos largely for this reason: fewer surprise repair bills in the first few years and strong warranty coverage if anything isn’t right.

Risks of Buying Pre-Construction

Construction Delays and Possible Cancellations

As exciting as pre-construction can be, I always advise my clients to go in with eyes wide open about the risks. Buying something not yet built has inherent uncertainties. Here are some of the key risks (and how to think about them) in Jatin’s honest take:

Delays are common in pre-construction – a project slated for 2025 might end up completing in 2026 or 2027. I prepare all my buyers for this possibility so they can plan their lives accordingly. In rare cases, a project might even get cancelled by the developer (for instance, if they don’t sell enough units or encounter financing issues). While you would get your deposit back in a cancellation, it can be heartbreaking and a lost time opportunity. Always have a backup plan for housing in case your move-in gets pushed back. (For peace of mind, learn what to do if a pre-construction project gets delayed or cancelled.)

Market and Financing Uncertainty

A lot can change in the few years while your condo is being built – housing market conditions, interest rates, your personal finances. If the market dips by completion time, the unit’s value might not be as high as you hoped. More critically, you’ll need to secure a mortgage approval when the condo is ready. If interest rates shoot up or lending rules tighten, some buyers find they can’t qualify for the mortgage they anticipated. I’ve seen cases where clients had to find alternative financing because the rate hikes made the mortgage payments much higher than planned. It’s crucial to maintain good credit and financial stability during the waiting period, and avoid over-leveraging. Consider getting pre-approved and keep in touch with your mortgage broker as the closing approaches.

Occupancy Fees and Hidden Costs

Before your condo is officially completed and registered, you may have an interim occupancy period where you’re paying rent-like fees before ownership officially transfers. During that phase, you pay a monthly fee to the developer (like rent) without building equity. This is an extra cost on top of your deposits. Additionally, closing costs for new condos are higher than for resale – they can include development charges, utility connection fees, Tarion warranty enrollment, and HST on new homes (if it’s an investment, HST rebates need to be handled). I always provide my buyers a detailed estimate of closing costs so there are no nasty surprises. But be aware: these costs can easily amount to 1–3% of the purchase price or more. If you’re not prepared, they can feel like a sucker-punch at final closing.

Product Uncertainty (What You See Isn’t What You Get – Yet)

-

Buying off a floor plan means you have to trust the developer’s plan and reputation. The final building might have minor differences from initial plans (maybe the lobby finishes are slightly different, or that nice view you paid extra for gets partially obstructed by a surprise new development next door). You won’t fully experience your unit until it’s built, and you can’t “test drive” it. There’s also a chance of construction quality issues – though the Tarion warranty covers defects, it’s still an inconvenience to deal with repairs after move-in. Essentially, there’s a leap of faith involved. I advise clients to only buy from reputable developers with a solid track record (more on Toronto’s top developers shortly) to minimize this risk. And remember, limited customization is possible – you can pick finishes, but you usually can’t change the layout or features beyond what the builder offers.

Does all this mean you should avoid pre-construction? Not at all. It just means due diligence is key. Work with experts (like a lawyer and an experienced agent) to review the contract and project details. Understand all the terms and your obligations. If you’re informed and prepared, you can mitigate many of these risks. For a deeper dive into the potential pitfalls, take a look at our full rundown of the [risks of buying a pre-construction condo] so you can make a confident decision with all facts in hand.

Toronto Rental and Seller Market 2025

Rental Market

As of October 2025, the average rent for a one-bedroom in Toronto is $2,368 per month. Condo vacancy rates remain low at 1–1.5%, pointing to strong ongoing demand. That’s slightly below the long-term average of 1.5–2%, and conditions are expected to stay steady through the end of the year.

With the population growing quickly and fewer people buying homes, rental activity has surged. At the same time, the number of available rental units is still high compared to past levels.

Seller Market

As of October 2025, new and pre-construction condos in Toronto are selling for about $1,000 to $1,500 per square foot. Across the GTA, the benchmark home price is $960,300, down 5.5% year-over-year and 1% month-over-month. The average selling price for all homes is $1,059,377, a 4.3% annual decline. Detached homes average $1.36 million (down 4.5%), semi-detached homes average $1.02 million (down 6.9%), freehold townhouses average $948,000 (down 3.5%), and condo apartments average $655,000 (down 4%).

On September 17, 2025, the Bank of Canada lowered its policy interest rate by 0.25% to 2.5%. This move, part of a series of recent cuts, is meant to support growth as inflation cools to around 2.5% and tariff-related uncertainties linger. We expect market activity to pick up gradually, with affordability improving as monthly payments better align with incomes after another one or two cuts. Home prices should remain stable or see modest growth of 0–2%, though condos may still feel pressure from oversupply.

Average Renting and Selling Time in Toronto

-New Condos

Renting Time for Condos: As of October 2025, Toronto rental condos stay on the market for 30 days.

Selling Time for Condos: New condos for sale in Toronto have an average price of $$685,961. These condos typically stay on the market for 30 days.

-New Homes

-Renting Time for Homes: As of October 2025, the average renting time for detached homes in Toronto is around 2 – 4 weeks.

-Selling Time for Homes: Homes typically remain on the market for approximately 21 days.

Best Neigbourhoods for Condo Investments

The Downtown Core

This area includes bustling neighbourhoods like the Financial District, Entertainment District, and St. Lawrence Market, known for their proximity to major business hubs and cultural landmarks.

1. Financial District

- Highlights: Major corporate offices, high-rise condos, vibrant nightlife

- Perfect For: Professionals and those who want to live close to work

- Pre-Construction Condos Near Financial District, Toronto:

2. Entertainment District

- Highlights: Theatres, nightclubs, restaurants, and major sports venues

- Perfect For: Those who enjoy active nightlife and cultural events

- Pre-Construction Condos Near Entertainment District, Toronto

3. St. Lawrence Market

- Highlights: Historic market, trendy lofts, community events

- Perfect For: Foodies and those who appreciate a mix of history and modern living

- Pre-Construction Condos Near St. Lawrence Market, Toronto

4. Harbourfront

- Highlights: Waterfront views, scenic trails, ferry access to Toronto Islands, cultural attractions

- Perfect For: Nature lovers, professionals, and anyone seeking a serene lifestyle with city convenience

- Pre-Construction Condos Near Harbourfront, Toronto

Midtown

Midtown encompasses neighbourhoods like Yonge and Eglinton, Forest Hill, and Davisville Village, offering a blend of urban and suburban vibes while hosting plenty of new pre-construction condos in Toronto.

1. Yonge and Eglinton

- Highlights: Shopping, dining, excellent transit options

- Perfect For: Young professionals and families looking for a lively, convenient neighbourhood

- Pre-Construction Condos Near Yonge & Eglinton

2. Forest Hill

- Highlights: Luxurious homes, prestigious schools, leafy streets

- Perfect For: Affluent families and those seeking an upscale lifestyle in Toronto pre-construction condos

- Pre-Construction Condos Near Forest Hill, Toronto

3. Davisville Village

- Highlights: Parks, good schools, family-friendly environment

- Perfect For: Families and those looking for a quiet, community-oriented area

- Pre-Construction Condos Near Davisville Village, Toronto

West End

This area includes neighbourhoods like Roncesvalles, High Park, and Bloor West Village, known for their unique charm and green spaces.

1. Roncesvalles

- Highlights: European feel, independent shops, strong sense of community

- Perfect For: Families and those seeking a vibrant, walkable neighbourhood

- Pre-Construction Condos Near Roncesvalles Village, Toronto

2. High Park

- Highlights: Expansive park, family activities, community events

- Perfect For: Nature lovers and families

- Pre-Construction Condos Near High Park, Toronto

3. Bloor West Village

- Highlights: Shopping, dining, close-knit community

- Perfect For: Families and those who enjoy a village-like atmosphere

- Pre-Construction Condos Near Bloor West Village, Toronto

East End

The East End includes neighbourhoods like The Beaches, Leslieville, and Riverdale, known for their laid-back vibe and community spirit.

1. The Beaches

- Highlights: Sandy beaches, boardwalk, waterfront activities

- Perfect For: Beach lovers and those seeking a relaxed lifestyle in pre-construction condos in Toronto

- Pre-Construction Condos Near The Beaches, Toronto

2. Leslieville

- Highlights: Trendy cafes, boutique shops, artsy vibe

- Perfect For: Young professionals and families looking for a hip, up-and-coming area

- Pre-Construction Condos Near Leslieville, Toronto

- The Poet Condos

- Queen & Ashbridge

- Wonder Condos

3. Riverdale

- Highlights: Parks, Victorian homes, vibrant community

- Perfect For: Families and those who enjoy a mix of historic charm and modern

- Pre-Construction Condos Near Riverdale, Toronto

Pros of Living in Toronto

- Diverse and Multicultural: With its many languages, nationalities, and customs, Toronto is one of the world’s most diverse cities. The city’s events, food, and neighbourhoods all mirror this variety, making it a lively and welcoming place to live.

- Robust Job Market: Toronto is Canada’s economic hub, and the job market is booming in many fields, including finance, technology, healthcare, and media. The city has a lot of job opportunities and draws the best people from all over the world.

- Excellent Public Transit: The Toronto Transit Commission (TTC) runs a large system of subways, buses, and streetcars that make getting around the city easy. The GO Transit network also ties Toronto to nearby places, making it easier for people to get to work.

- World-Class Education and Healthcare: Toronto is home to many prestigious Canadian universities, such as York, Ryerson, and the University of Toronto, with over 97,000 students in the University of Toronto alone. The city also has some of the best hospitals like the Toronto General Hospital and Sick Kids Hospital.

- Vibrant Arts and Culture Scene: There are many places to enjoy the arts and culture in the city, including galleries, theatres, museums, and concert halls. The city’s cultural scene is always evolving because of events like Caribana and the Toronto International Film Festival (TIFF).

Cons of Living in Toronto

- Higher Costs: Rent and prices for new condos for sale in Toronto are among the highest in Canada, impacting affordability for many people. The city is notorious for its high cost of living, especially when it comes to housing.

- Traffic Congestion: Even though Toronto has great public transportation, traffic is often severe, especially during rush hours. Driving to work can be annoying and takes a lot of time.

- Weather Extremes: Toronto’s weather changes a lot from summer to winter. In the winter, it gets cold and wet. The weather in the city might not be perfect for everyone.

Best Private Schools Near Pre-Construction Condos in Toronto

For families buying a pre-construction condo, being close to Toronto’s top private schools is a major advantage. These schools offer exceptional academics, extracurriculars, and university placement, making them a key consideration for end-users and investors alike. Living near a prestigious school can also help boost long-term property value.

Some of the most sought-after private schools in Toronto include:

- Upper Canada College – All-boys school with a strong academic and leadership focus

- Branksome Hall – Leading IB World School for girls from JK to Grade 12

- Havergal College – Independent girls’ school known for academic excellence

- Crescent School – All-boys private school emphasizing character development and innovation

- Bishop Strachan School – One of Canada’s oldest girls’ schools with a rigorous academic program

Explore the full list of Toronto’s top 15 private schools here.

Top Condo Developers in Toronto

Toronto’s skyline is dotted with projects from dozens of developers, but not all builders are equal. Choosing a reputable developer can make a huge difference in your pre-construction experience – from build quality and after-sales service to likelihood of delays. (Learn more about Tridel and other top developers in our full rankings.) Here are three of the top condo developers in Toronto (in my experience and as recognized industry leaders), along with examples of their notable projects:

Top 3 Trusted Names in Toronto Condo Development

Tridel

Tridel is practically a household name in Toronto – they’ve been building condos for over 80 years and have completed over 85,000 homes. When you buy a Tridel condo, you’re investing with a developer known for quality construction, innovative designs, and sustainable building practices (Tridel is frequently a winner of “Green Builder of the Year” awards). They tend to deliver on time and have a strong customer care program. Tridel’s condos often anchor new community developments, including retail and park spaces, which adds value for residents. Notable projects by Tridel include Ten York (a landmark 65-storey tower near Toronto’s waterfront), Auberge on the Park (a multi-tower community at Leslie & Eglinton, including Château Auberge), and The Well (a highly anticipated mixed-use project downtown in collaboration with other builders). With Tridel, you can expect modern amenities, smart home features, and thoughtful layouts born from decades of expertise.

Menkes Developments

Menkes is another powerhouse in the GTA development scene, with a history spanning over 65 years. They’re a fully integrated real estate company – meaning they handle everything from development to property management – which often translates to a well-run building in the long term. Menkes has a reputation for high-end projects and was behind Four Seasons Private Residences in Yorkville, one of Toronto’s most luxurious condo offerings. They also developed Harbour Plaza Residences (two sleek towers connected to the PATH downtown) and NY Walk Towns in North York. Menkes projects are known for elegant design and quality finishes; they also focus on sustainable building (many Menkes buildings are LEED certified for green construction). I’ve had clients purchase in Menkes buildings who loved the combination of location and build quality – these condos tend to hold their value well. If you’re looking at a Menkes pre-construction project, you’re likely considering a solid investment backed by a longstanding Toronto developer.

Great Gulf

Great Gulf might not have the same public name recognition as Tridel, but in the industry, they are highly respected. With over 40 years in business, Great Gulf is known for innovative architecture and technology-driven building. They are the developer behind some of Toronto’s most striking modern condos. For example, One Bloor East (the curvaceous glass tower at Yonge & Bloor) is a Great Gulf project that turned heads and quickly became an icon. They also built Monde Condos (a waterfront tower famed for its distinctive design and winner of architectural awards) and Charlie Condos in King West. Great Gulf has teamed up with celebrated architects, like their upcoming project Forma, designed by Frank Gehry & Quayside Condos, showing their commitment to cutting-edge design. They’ve won awards like Home Builder of the Year and consistently push for greener, smarter building practices. Buyers in Great Gulf projects often mention the excellent build quality and stylish common areas. With Great Gulf, you’re getting a blend of creativity and reliability – a combo that’s spawned some of the most desirable addresses in the city.

What to Check Before Buying a Pre-Construction Condos in Toronto

When you’re about to buy pre-construction, doing your homework can save you from headaches later. Here’s a handy checklist I go through with all my buyers (consider this Jatin’s “pre-construction prep list”):

-

Lawyer Review

Before signing anything, have your Agreement of Purchase and Sale reviewed by a real estate lawyer to avoid surprises. An experienced lawyer will check for hidden costs, unfavorable clauses, and ensure your interests are protected. Here’s why hiring a real estate lawyer for your property purchase is essential — especially in pre-construction deals, where contracts are lengthy and heavily weighted in the builder’s favour.

-

Understand Interim Occupancy

Know that you may need to move in before you officially own the unit. This period – interim occupancy – is when you take possession and can live in the condo (or rent it out, if allowed) but title hasn’t transferred yet. You’ll pay a monthly occupancy fee (often roughly equivalent to interest on the unpaid balance, plus condo fees and taxes) to the developer during this phase. It feels like “rent,” and it does not go toward your purchase price. It’s crucial to budget for these months because you’ll be paying this fee in lieu of a mortgage payment until final closing. Learn more about interim occupancy fees in pre-construction condos and how they impact your budget — it’s an important part of the purchase agreement most buyers overlook.

-

Review the Deposit Structure

Get a clear schedule of how much you’re paying in deposits and when. For example, it might be 5% in 30 days, 5% in 120 days, 5% in 365 days, and so on. I always recommend marking these dates in your calendar and ensuring you have the funds ready ahead of time. Also, ask about penalties or cancellation terms if you miss a payment. Understanding your deposit obligations will help you avoid any default — which could put your entire purchase at risk. I’ve outlined how pre-construction deposit structures typically work in Toronto to help my clients plan ahead and stay on track financially.

-

Know the Assignment Rules

An assignment is when you sell your purchase contract to someone else before the project is finished — in other words, you flip the condo to a new buyer prior to closing. Not all builders allow this, or they may charge a fee and set strict conditions (like prohibiting MLS advertising). Even if you plan to keep the condo, I always advise my clients to secure the option to assign in case their circumstances change. Always check if the developer permits assignment, what the fee is (often $5,000 or more), and what restrictions apply. If you think you might take advantage of this, negotiate for a free or low-cost assignment clause up front. For a deeper explanation, read my full guide on assignment sales and the potential risks involved.

-

Cooling-Off Period

Remember that Ontario law gives you a 10-day cooling-off period after signing the agreement. Use it wisely. During these 10 days, finalize your financing and have your lawyer carefully review all the documents. If you have second thoughts or your lawyer spots any red flags, you can back out without penalty. After the 10th day, you’re fully committed — so this is essentially your safety hatch. I always remind my clients to make their decision by day 9 at the latest so they’re either confident to proceed or prepared to walk away. You can learn more about how the 10-day cooling-off period works in this first-time buyer guide I put together.

-

Work with a Platinum Agent for VIP Access

The best deals and selections often happen before the public launch. By working with a Platinum agent (like me), you can get exclusive front-of-line access to upcoming projects. This means better pricing, more choice of units, and sometimes bonus incentives (like a cap on levies or free upgrades) that the general public won’t get. I help my clients navigate these early sales events, which can be hectic. The takeaway here: if you want a top unit in a high-demand project, don’t go it alone – leverage insider access. If you’re new to the process, here’s what working with a Platinum pre-construction agent really means and why it gives you a serious advantage.

-

Act Quickly at Launch

If you’re trying to secure a unit at a launch, preparation is key. We often have to make decisions on unit selection quickly — sometimes within hours. Have your top 3 choices of floor plans and floors ready, know your budget limits, and be available to sign documents and deliver deposit checks immediately. Pre-construction launches can feel like a race — and they kind of are. With the groundwork we’ve laid (pre-approval, research, etc.), you’ll be ready to sprint when the window opens. For an inside look at my launch day strategies and how to secure your ideal unit at a pre-construction launch, check out this guide.

-

Ask Smart Questions at the Sales Office

When you attend a sales centre or model suite, don’t be shy – ask questions beyond the flashy scale model. Great questions include:

- What are the estimated condo fees per square foot?

- Are there any developer adjustments at closing (caps on fees)?

- What’s the policy on leasing during occupancy?

- Is parking or locker included or available for purchase?Also ask about the neighborhood: Any major developments planned nearby (that could affect your view or value)? I arm my clients with a checklist of questions so we leave no stone unturned. The sales reps are there to sell, but you need information. Knowledge is your bargaining chip, even when terms seem fixed.To help you prepare, here’s my list of the top questions to ask at a pre-construction condo sales office so you don’t miss anything important.

By ticking off each of these items, you’ll enter the purchase with confidence. Buying pre-construction is a significant commitment, but thorough preparation separates the successful, stress-free buyers from the rest. Every time my clients have followed this checklist, they’ve thanked me for it later!

How to Buy Pre-Construction Condos in Toronto (Step-by-Step)

Buying a pre-construction condo is a different process than a regular resale purchase. It’s a bit more complex and drawn out, but I guide my clients through it step by step. Here’s a simple breakdown of how to buy a pre-construction condo in Toronto, from my perspective. I’ve also put together a helpful guide specifically for first-time pre-construction condo buyers that outlines everything you need to know before getting started.

The Buying Process: From Floor Plan to Final Closing

Secure Your Finances and Mortgage Pre-Approval

Before you even start looking at floor plans, get your budget sorted. Meet with your bank or a mortgage broker to understand how much you can afford and get a mortgage pre-approval. This will give you a clear price range to work with. Remember, pre-construction deposits are usually 15–20% of the purchase price (paid in installments), so ensure you have a savings plan for that. Also, factor in closing costs (which can be 1–3% of the price). By having financing ready, you’ll be able to act quickly when the right opportunity comes. For a deeper dive into this topic, check out my essential guide to down payments and budgeting for home buyers.

Research Locations and Developments (Define Your Goals)

Think carefully about where in Toronto you want to buy and what your goals are — whether it’s for investment or personal use—and what your timeline looks like. I always recommend researching upcoming projects in your preferred area. This is where working with a Platinum pre-construction agent like myself becomes invaluable — I often have insider knowledge on upcoming launches and know which projects offer the best long-term value. As you do your research, consider the neighborhood: does it match your lifestyle, or if you’re investing, does it have strong rental demand? Also, pay attention to the builder’s track record and the projected occupancy date.

Choosing the right unit isn’t just about the floor plan — it’s about lifestyle and long-term potential. Your commute, the amenities you’ll actually use, the vibe of the community, and even the condo’s exposure (sunlight, views, etc.) all impact your day-to-day experience and future resale value. 📘 To help you through this process, I’ve put together a detailed guide on how to choose the right pre-construction condo for your goals — give it a read before making your decision.

Work with a Platinum Agent & Attend VIP Launches

In the pre-construction world, timing is everything. The best units often sell in the Platinum or VIP sales phase, which is before the public sales office opens. As a Platinum agent, I get early access to many of these developments – and I help my clients secure units at first-release pricing, often with the most incentives (like discounts or free upgrades). If you’re not familiar with this process, here’s a full guide to Platinum VIP access in pre-construction and how it benefits early buyers.

Once you’ve identified a project you like, your agent will submit a worksheet/reservation for a unit on your behalf. If you’re allocated a unit, you’ll attend a sales centre appointment to firm up your selection. Be prepared to act fast: popular projects can sell out of certain unit types within days or even hours. It’s a bit like getting tickets to a hot concert – you want to be at the front of the line. (Don’t worry, with preparation and my guidance, we make sure you’re ready to go!)

Review the Floor Plan, Price, and Incentives

Once you have a specific unit in mind, you’ll review all the details. This includes the floor plan layout, the view/exposure, what’s included (parking or locker, if applicable), and the final price with any developer incentives. Developers often provide an info package – read everything carefully. At this stage, you usually place a small reservation deposit (e.g., $5,000) to hold the unit while the paperwork is prepared. I help my clients analyze floor plans in pre-construction condos to spot layout flaws, assess efficiency, and ensure it suits their lifestyle or investment goals. I also compare the price per square foot against market averages and verify that any incentives or promotions offered by the developer — like capped development charges or free upgrades — are documented in writing. Don’t hesitate to ask questions now – it’s much easier to address concerns before you sign the formal Agreement of Purchase and Sale.

Sign the Agreement of Purchase and Sale (APS)

pages) containing all the terms, floor plan sketches, condo bylaws, etc. Never sign it blindly. In Ontario, you have a 10-day cooling-off period after signing a pre-construction APS – this is your window to have a lawyer review the agreement and to arrange financing confirmation.

I always insist my clients use this period wisely. Having a real estate lawyer for your pre-construction purchase is critical. Developers’ contracts are designed to protect them — not you — and a good lawyer can spot hidden clauses, fees, and risks, and even negotiate necessary amendments.

Also use this time to finalize mortgage details with your lender. If something unacceptable comes up (maybe the lawyer finds an unfavorable clause, or financing falls through), you can cancel the deal within these 10 days with no penalty and get your deposit back. Once you’re satisfied, you’ll firm up the deal. The first deposit (minus any reservation you paid) is usually due on the 10th day, so be ready to provide the funds as per the deposit schedule. For a complete understanding, refer to our guide on the Pre-Construction Purchase Agreement and key clauses to watch for.

During Construction – Stay Informed

After the deal is firm, the waiting game begins. The build process typically takes a few years. The developer will send out occasional construction updates and notices of any schedule changes. It’s important to keep your contact info up to date with them. In the meantime, continue saving money if needed (you’ll have more deposits due over the first 1-2 years as per your schedule). Avoid major life changes that could affect your finances until after you’ve closed (like buying a new car on credit, etc.) because you want to ensure your financial picture remains solid for your eventual mortgage. If your project has Platinum events (hard hat tours, model suite viewings), take advantage – it’s a great way to connect with your future home. And of course, I keep an eye on things for my clients, updating them on any relevant news (like if the developer plans to advance occupancy dates or if market conditions suggest any strategy changes).

Throughout these steps, lean on your real estate agent (hi there 👋) and your lawyer for guidance – that’s what we’re here for. Buying pre-construction can feel complex, but with the right team, it’s very manageable. Now, before you sign on the dotted line, let’s go over a checklist of things you should always verify or understand before buying a pre-construction condo.

What to Expect After Purchase (Closing & Beyond)

Congratulations – you’ve signed on the dotted line and the condo is officially yours (at least on paper)! Now, what happens between that point and the day you have the keys in hand, and even the months after? This phase can be a bit mysterious, so let me demystify it. Here’s what to expect after purchasing a pre-construction condo in Toronto, in roughly the order you’ll encounter things:

-

Waiting for Construction to Finish

First comes a whole lot of patience. During the construction period (which could be a couple of years), your main job is to stay informed and keep your finances in order. The builder will periodically update you on milestones — like excavation, structural progress, or when the building reaches a certain floor. As the projected occupancy date gets closer, you’ll receive an official Occupancy Date Notice (typically 90 days out) letting you know when your unit is expected to be ready. I always advise my clients to stay in touch with their agent or log into the builder’s portal for regular updates. It’s also a great time to start planning ahead: will you live there or rent it out? If it’s an investment, consider lining up a property manager or begin networking for potential tenants a couple of months before occupancy. To understand each stage, here’s a breakdown of the phases of a pre-construction condo project so you know exactly what to expect.

-

Interim Occupancy & Occupancy Fees

After the building is built enough that your unit is habitable (even if the rest of the building isn’t 100% complete), you’ll enter what’s called the interim occupancy phase. This means it’s time to pick up the keys and potentially move in! However – you don’t own the unit yet. The building might not be legally registered (that can take months after everyone moves in). During interim occupancy, instead of mortgage payments, you’ll pay the developer a monthly occupancy fee. This fee usually covers interest on the unpaid balance of your condo (at a prescribed rate), an estimate of the condo maintenance fee, and property taxes.

It can feel a bit frustrating because these payments do not reduce your mortgage principal – they’re more like rent to the developer for living in the unit early. In my experience, interim occupancy in Toronto condos can last anywhere from a few months up to a year, depending on how quickly the builder completes final steps. It’s important to budget for this extra “rent-like” period. I always make sure my clients understand this phase clearly — we don’t want any surprises. If you want the full breakdown, here’s my detailed guide on how interim occupancy fees work in pre-construction condos.

-

PDI – Pre-Delivery Inspection

Just before or around the time of occupancy, you’ll have your Pre-Delivery Inspection (PDI). This is an exciting milestone – it’s the first time you see your finished unit! During the PDI, you (and often your agent or a representative) walk through the condo with the builder’s representative. You’ll go room by room to inspect for any defects, incomplete work, or damage. This is your chance to note any issues – scratches on floors, unpainted spots, appliances not working, etc. – on a PDI form. Don’t be shy about pointing things out; the builder will have to address these either before you move in or shortly after. I always accompany my clients to PDIs to help spot issues (two sets of eyes are better than one). Remember, cosmetic deficiencies, missing fixtures, etc., all get logged. Major issues are rare if it’s a good builder, but minor tweaks are common (paint touch-ups, cabinet alignment, etc.). The PDI is also when the builder might show you how to operate the systems (thermostat, appliances, etc.), so pay attention as it will soon be your home!

-

Final Closing Process

The big day comes a few weeks or months after you’ve moved in (depending on how long that interim occupancy lasts) – final closing. This is when the building is registered with the city, and your unit officially transfers to your name (title transfer). At this stage, your lawyer and the builder’s lawyer complete the transaction. Your mortgage kicks in (the bank will send the funds to the lawyer, you provide the remainder of your down payment if any, and the title is transferred to you). You’ll also settle all the closing costs now. These can include Land Transfer Tax (Toronto has a double land transfer tax, municipal and provincial, so budget accordingly), development charges and levies (if not capped, these can add up), legal fees, and any adjustments (for things like prepaid taxes or fees). On final closing day, once all funds are in and paperwork is done, you’re officially the owner – congratulations, your name is on title! This is also when you get any remaining keys/fobs, and usually, the builder will release any deposits they were holding (for example, sometimes they hold back a last key deposit or something; your lawyer will adjust all this). I always tell clients: final closing is like a second closing, so be prepared for another round of payments and documents. But after this, the condo is truly yours.

(In summary, final closing includes things like title transfer, registering the mortgage, involvement of your lawyer for all the closing documents, and you transitioning from occupancy fees to mortgage payments.)

-

Dealing with Delays (If They Happen)

It’s not uncommon in Toronto for final registration to be delayed a bit, or even occupancy dates to shift. If your interim occupancy gets extended (say, the builder needed extra time to finish amenities or get city approvals), you might be paying occupancy fees longer than expected. This can be frustrating, I know. The key is to stay calm and plan. Builders have outside dates in the contract – they can’t delay indefinitely. If they go past a certain long-stop date, buyers may have rights to compensation or even to cancel (with refund) in extreme cases. But that’s worst-case. More often, it’s a few months here or there. I keep tabs for my clients and assist in case of delays – whether it’s helping them arrange short-term accommodations or negotiating any perk due to delay (some developers might throw in an extra free upgrade or small compensation if timelines really slip, though it’s not guaranteed). Communication and patience are your allies. For strategies on how to handle delays and understand your legal options, read my article on what to do if your pre-construction condo project gets delayed or cancelled.

-

Tarion Warranty Coverage

Every new condo in Ontario comes with Tarion Warranty Program coverage. It’s automatically included (though you’ll pay the enrollment fee as part of your closing costs). The Tarion warranty provides several layers of protection: 1-year coverage for defects in workmanship and materials, 2-year coverage for electrical, plumbing, HVAC systems, and water penetration, and up to 7 years for major structural defects.

After you move in, if you notice any issues — a plumbing problem, a drafty window, or something cosmetic — you’ll report them to Tarion and the builder using the 30-day and 1-year forms. Tarion ensures the builder addresses any warranted issues. It’s really important to understand what’s covered and when to submit claims, because missing a deadline could mean the repair becomes your responsibility.

I always advise my clients to keep a running list of non-urgent issues as they settle in, and we’ll submit them at the right time. Major problems are rare, but small fixes (like drywall pops or a sticky door) are pretty common in the first year. The good news is, you’ve got a safety net. If you want to dive deeper, here’s my guide to the Tarion New Home Warranty Program and what it covers.

-

Registration and Title Transfer (Building Registration)

This part can be a bit confusing – essentially it’s part of final closing, but on a building-wide scale. A condo doesn’t legally exist as separate units until the condo corporation is registered with the Land Registry Office. This usually happens a few months after all units are occupied. Once registration happens, that triggers final closings for everyone. The time frame can range; commonly, I see 3-6 months after occupancy start, but it could be longer for very large projects or if there were construction hold-ups. After registration, you’ll get that notice for your final closing date as described. The moment you close, you become the official owner and the condo corporation also officially comes into existence (owners will eventually have their first condo board meeting, etc.). It’s a big milestone because it means the developer is one step closer to finishing their job and handing over the reins to the owners’ condo board.

-

Assignment Restrictions or Options

After you’ve purchased (signed the APS) and even during construction, you might have a change of heart or circumstances where you consider assigning your contract to someone else — essentially selling the unit before you take possession. As mentioned earlier, this is only possible if your contract allows it. Many investors plan for this exit strategy, often aiming to flip the contract for profit if the market has gone up. Just keep in mind, even after you’ve moved in, some builders restrict assignments until final closing.

Once you’ve closed and taken title, selling the condo is simply a regular resale — no longer an assignment. If you plan to assign during interim occupancy, make sure you follow the builder’s rules: you’ll usually need written approval of the assignee, and the new buyer must accept all original contract terms. Also, be aware of potential HST implications and assignment fees — your lawyer and accountant should review everything. I’ve written a full breakdown of how assignment sales work and the risks involved — it’s a must-read if you’re considering this strategy.

And before any of this becomes an option, remember that the key terms — including assignment rights, penalties, and long-stop dates — are written into your APS. That’s why understanding the pre-construction purchase agreement is so important. I walk my clients through it line by line so they know exactly what they’re signing.

After all these steps, you’ll be settling into your new condo for good. The journey can feel long, but as I often say on closing day: when you walk into that brand-new unit you chose years ago, it’s all worth it. You’ve watched a concrete shell turn into a home. Whether you’re an owner-occupier enjoying the shiny new amenities or an investor handing the keys to your first tenant, give yourself a pat on the back. Navigating Toronto’s pre-construction market isn’t for the faint of heart — but with the right guidance (hopefully I’ve provided that!) and some due diligence, it can be one of the most rewarding decisions you make, both personally and financially.

Toronto Pre-Construction Buyer’s Summary: Final Advice & Insights

Buying a pre-construction condo in Toronto is an exciting way to secure a piece of this vibrant city’s future. You’ve now got a solid overview of the process, the pros and cons, the key players, and the neighborhoods that might suit your lifestyle or investment goals. My goal as a seasoned agent (and your guide in this write-up) is to empower you with knowledge and insider tips – so when you decide to take the leap, you do so with confidence and clarity.

If you have any questions or need personalized advice, don’t hesitate to reach out. I’ve helped many clients, from first-timers to seasoned investors, navigate the pre-construction maze, and I’m passionate about making the journey as smooth as possible for you. Happy condo hunting, and maybe one day you’ll be gazing out from the balcony of your new Toronto condo, remembering that it all started with a bit of research and a big dream!

Neighborhoods in Toronto

- Agincourt

- Agincourt South-Malvern West

- Baby Point

- Bathurst Manor

- Bayview Village

- Beaconsfield Village

- Bendale

- Birch Cliff

- Bloor West Village

- Bloordale Village

- Brockton Village

- Cabbagetown

- Casa Loma

- Centennial Scarborough

- Chaplin Estates

- Chinatown

- Christie Pits

- Clairlea-Birchmount

- Cliffcrest

- Cliffside

- Davisville Village

- Deer Park

- Distillery District

- Don Valley Village

- Dorset Park

- Dovercourt Park

- Downsview

- Dufferin Grove

- East York

- Edenbridge-Humber Valley

- Emery

- Forest Hill

FAQs About Buying New Condos in Toronto

In October 2025, pre-construction condos in Toronto range from about $1,000 to $1,500 per square foot. Prices are highest downtown, while suburban areas are easier on the budget. Across the GTA, the benchmark home price sits at $960,300.

From 2010–2025, Toronto condo prices rose 5–7% annually, doubling by 2022 before softening. As of 2025, growth has cooled, yet long-term demand keeps values relatively resilient.

Minimum downpayment is 5% for condos below $500,000. For condos or townhouses for sale in Toronto up to $999,999, it’s 5% of the first $500,000 and 10% of the remaining sum. For condos $1M and above, minimum downpayment is 20% of the whole price.

As the 11th fastest-selling city in Canada, condos and townhome developments in Toronto are always in high demand.

Toronto stands as the 12th most expensive city in Canada, which is reasonable given the high demand for new homes in Toronto, including condos.

Choosing condos or detached homes in Toronto means you can enjoy easy access to state-of-the-art fitness centres, rooftop patios, and vibrant communal spaces. Depending on your choice, you can enjoy the skyline views from high-rise buildings or waterfront vistas of new townhomes in Toronto.

Toronto will soon have the most high-rise condos of any city in the world. Young single workers between the ages of 25 and 35 want to live in the downtown centre. This is also where the city’s rental market has grown so quickly over the last ten years. A lot of brand-new homes that have already been built are on the market. This will help Toronto grow, stay competitive, and improve people’s quality of life.

Toronto’s new condo rental market in 2025–2026 is softening. Vacancy rates are higher, especially for smaller units, and average rents are down. Renters have more options and bargaining power, while well-located, larger condos remain relatively resilient compared to studios.

In North America, Toronto is among the most accessible major cities. You can easily get around Toronto with the Toronto Transit Commission (TTC), in addition to numerous buses, streetcars, and subways.

The Downtown area, Midtown, West End, and East End are high in demand, and you may want to put them on your house-hunting shortlist.

Toronto is packed with some of the country’s best schools and colleges, including the University of Toronto, Ryerson University, and York University.

Toronto’s 2025 economic outlook indicates a steady recovery, bolstered by lower interest rates and a rebounding housing market. However, structural issues and external economic risks may moderate growth expectations.

Toronto’s 2025 development plans focus on economic growth, housing, and infrastructure. Key initiatives include the “Sidewalks to Skylines” economic plan, government-owned land development for housing, a new design catalogue for affordable housing projects, the Port Lands Flood Protection Project, and major transit expansions like the Ontario Line. Additionally, the Toronto Community Housing Strategic Plan (2025-2029) aims to enhance tenant engagement and sustainable housing solutions.

Simply subscribe to our newsletter and register at our Platinum Condo Deals website to get exclusive access to the latest info on the Toronto condos for sale.