Step-by-Step Guide for First-Time Pre-Con Buyers

Now, you have made up your mind and come to the conclusion that buying a pre-construction condo is a wise move to enter the real estate market. You want to get started, but are not sure how to take the next step.

That’s where this first-time pre-construction buyer guide comes in.

Below, we will share a detailed yet simple first-time condo buyer process, take a closer look at what buying pre-construction means, and weigh the advantages of this real estate investment option to help you understand the market and industry jargon better.

Why First-Timers Choose Pre-Construction?

With over 15 years of experience in pre-construction condo sales, I’ve seen why first-time homebuyers are drawn to this opportunity. Pre-construction condos offer extended deposit structures, giving buyers more time to save for their down payment. Locking in current market prices often means property appreciation by the time construction is complete. Buyers also benefit from customizing their units and receiving full new home warranties. It’s one of the most strategic and affordable ways to build equity and enter the real estate market with confidence.

Read: What is a Pre-Construction Condo?

Pros and Cons of Buying Pre-Construction Condos

| Pros (Advantages) | Cons (Risks) |

1. Lower Initial Purchase Price In my experience, early-phase buyers often get in at the best prices. Developers usually launch with lower pricing and raise it as the project sells. That means many of my clients have seen instant equity just by buying early — especially in high-demand areas. | 1. Market Value Uncertainty There’s always a chance the market cools. I’ve seen cases where appraisals came in low at closing, and buyers had to either come up with the difference or walk away from their deposit. Pre-construction is a long game — timing matters. |

2. Extended Deposit Structure Unlike resale, pre-construction lets you pay the deposit in stages over months or even years. This gives first-time buyers the time to save, and investors the flexibility to get in with less upfront capital. It’s one of the most flexible entry points into the market I’ve seen. | 2. Deposit Tied Up for Years The deposit sits with the builder during construction — and earns you no return. In a hot rental market, you could have put that money into a resale property and started cash flowing. That’s the trade-off. |

3. No Bidding Wars With resale homes, you’re often competing against 10 other buyers. In pre-con, you walk into a sales centre and buy at a fixed price. There’s no stress, no emotional rollercoaster — just a straightforward process. My clients love that predictability. | 3. Financing and Closing Risks Just because you’re approved today doesn’t mean you’ll qualify at closing — especially if interest rates rise or mortgage rules change. I always tell clients: plan for worst-case financing, not best-case. |

4. Customization and New Design You’re not moving into someone else’s idea of a home. You get to choose your finishes, colours, and upgrades. Plus, everything is brand new — appliances, flooring, mechanical systems — and you’re covered under warranty. Fewer headaches and lower maintenance. | 4. Construction Delays Delays are common. I’ve had clients waiting 6 months to a year longer than expected. If your move-in timeline is tight, or you’re relying on that income to kick in, this could throw a wrench in your plans. |

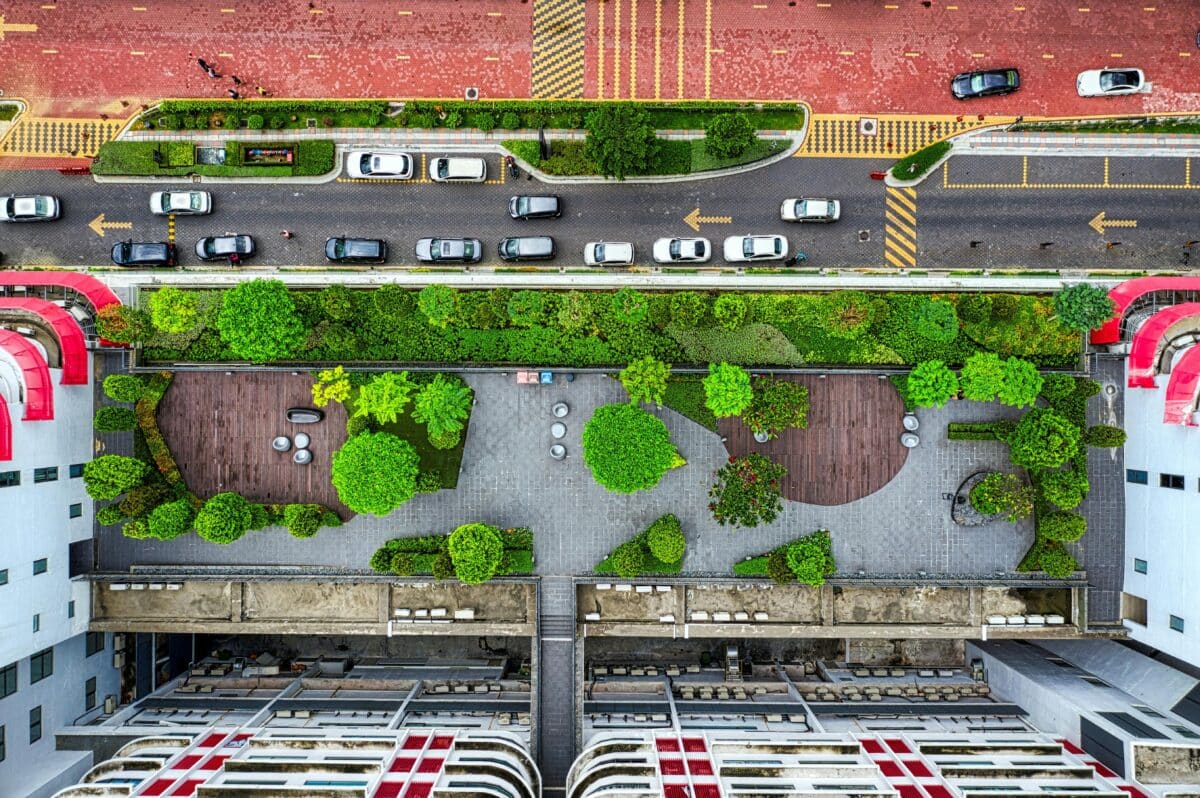

5. Modern Amenities and Energy Efficiency Today’s new builds come packed with amenities: co-working spaces, gyms, rooftop lounges, smart security — and they’re built to today’s efficiency standards, so they’re cheaper to operate and easier to rent out or resell. | 5. The Final Product May Vary What you see in the brochure and model suite isn’t always what you get. Minor layout changes, size adjustments, or finishes can differ. It’s all in the fine print — and I always review it with my clients. |

6. Appreciation Potential Over the years, I’ve watched many buyers walk into strong equity positions by the time the project closes. If the market grows while the building is under construction, you win just by holding the contract — a big reason investors love this strategy. | 6. Additional Closing Costs Don’t forget development charges, HST (in some cases), utility setup fees, and rising condo fees post-registration. Many first-time buyers are surprised by the final closing costs if they don’t budget ahead. |

| 7. Investor-Friendly Policies Most new condos come with flexible rental rules. No outdated restrictions, no legacy red tape. For investors, this means easier leasing, better resale, and more tenant demand. Plus, the warranties transfer, making resale even smoother. | 7. Developer Risk Not all builders are equal. Some projects have been cancelled mid-way, especially with smaller or less-capitalized developers. That’s why I only recommend projects from proven builders with a solid track record — reputation matters more than anything. |

First Home in Ontario: How Much Do You Need?

Buying your first home in Ontario – especially if you’re eyeing a pre-construction condo – means understanding the upfront cash requirements. The amount you need can vary significantly between a resale home and a pre-construction condo. Below is a detailed scenario table comparing the minimum down payment for resale purchases versus the typical deposit required for pre-construction condos at different price points:

| Home Price | Resale Home (Min. Down Payment) | Pre-Construction Condo (Deposit Requirement) |

| $400,000 | 5% (≈ $20,000) | 5–20% (≈ $20,000/$80,000) |

| $600,000 | 5.8% (≈ $35,000) | 5–20% (≈ $30,000/$120,000) |

| $1,500,000 | 10% (≈ $150,000) | 5–20% (≈$75,000/$300,000) |

Read: Buying Pre-Construction: What are Deposit Structures?

Financial Aspects of Buying a Pre-Construction Condo

When budgeting for a pre-construction condo, first-time buyers need to account for several financial factors that differ from an ordinary resale purchase. Below, we explore the major monetary components of buying a pre-con condo and what they mean for your wallet.

Upfront Deposit vs. Down Payment

One of the biggest differences with pre-construction is the deposit structure. Instead of a single down payment at closing, you’ll make a series of deposit installments to the builder during the construction period. For example, a typical deposit structure might be: $10,000 on signing, 5% in 30 days, another 5% within a year, and the remaining 10% on occupancy, totaling about 20% of the purchase pricereddit.com. This means on a $500,000 condo, you could be paying around $100,000 in deposits over the construction timelinefacebook.com. By contrast, a resale home can be bought with as little as 5% down (for the first $500k, then 10% on the portion above $500k)linkedin.com, so a $500,000 resale home might only require a $25,000 down payment (if mortgage insured).

- Deposits for Pre-Construction: Expect to put down roughly 15–20% of the condo price in total deposits before closing. The good news is these deposits are spread out over time (often 1–2 years or more), giving you time to save between installments.

- Down Payment for Resale: By law, the minimum down payment in Canada is 5% of the first $500,000, and 10% for any portion of the price from $500,000 to $999,999linkedin.com. Homes $1 million and up traditionally required 20% down (no mortgage insurance), although recent changes allow insured mortgages on homes up to $1.5Mnerdwallet.com. This means a first-time buyer purchasing an $800,000 resale home would need about $55,000 down (approximately 6.9%), whereas a pre-construction buyer likely needs closer to $120,000 (15%) or more upfront (in stages).

It’s important to note that your deposit on a pre-construction condo ultimately becomes your down payment. Come closing time, the deposit money you’ve paid is credited toward the purchase. If you end up depositing more than the minimum down payment required, you essentially build extra equity or can finance a bit less. Also, Ontario’s Tarion Warranty Program provides some deposit protection (up to $20,000 for condos) to protect buyers if the builder fails to complete the projectfacebook.com. However, since deposits often far exceed this amount, you should only buy from a reputable builder (more on that later).

Closing Costs and Other Expenses

Whether you buy resale or pre-construction, you’ll encounter additional closing costs. It’s critical to budget for these so there are no surprises:

- Land Transfer Tax (LTT): Ontario charges a land transfer tax on property purchases. As a first-time buyer, you’re eligible for a rebate up to $4,000 on this taxwowa.ca, which for many starter homes can wipe out most or all of the provincial LTT. (For example, no provincial LTT is payable on homes up to $368,000 thanks to this rebatewowa.ca.) If your home costs more, you pay the remaining LTT above $4,000. Note: If you buy in Toronto, there’s an extra municipal land transfer tax, but first-timers get an additional rebate up to $4,475 for thatwowa.ca.

- Legal Fees: You’ll need a real estate lawyer to review documents and handle the closing. Legal fees and disbursements can range roughly $1,500 – $2,500. For pre-construction, it’s especially important to have a lawyer review your purchase agreement (often during the cooling-off period) – we’ll discuss that later.

- New Home Specific Charges: Pre-construction purchases can involve development charges, education levies, utility hook-up fees, Tarion enrollment fee, etc. Builders often pass these costs onto the buyer at closing. Make sure your agreement of purchase and sale has caps on these adjustment fees so you know the maximum you might pay. It’s not unusual to budget a few thousand dollars for these levies on a new condo.

- HST and Rebates: Newly built homes in Ontario are subject to HST (13%), but if you’re buying the unit as your principal residence, you likely qualify for the GST/HST New Housing Rebate. Builders typically include the rebate in the purchase price – effectively reducing the price by the rebate amount (up to $24,000 in Ontario)taxtron.ca. This means if you move in and occupy the unit, you won’t have to pay the full 13% HST out of pocket. However, if you’re an investor (not moving in for at least a year), you’d have to pay the HST on closing and later apply for a rebate for rental properties. First-time buyers intending to live in their condo usually don’t need to worry, as the builder handles the paperwork for the rebate. Just be aware that the rebate exists and is a significant saving on new homes.

- Interim Occupancy Fees: A unique cost with pre-construction condos is the interim occupancy fee. This is essentially a “rent” you pay to the developer if you occupy the unit before you take ownership (i.e., after the unit is completed but before the condo building is officially registered and your purchase closes). The fee often covers interest on the unpaid balance, estimated taxes, and maintenance. While this isn’t equity or mortgage payment, you need to budget for these interim months. For example, if your unit is ready in June but registration (final closing) is in December, you’ll pay an occupancy fee each month for that period. Think of it as a temporary housing cost – it ends once you get your mortgage and take title of the condo.

In summary, beyond the purchase price and deposit, budget roughly 3–5% of the purchase price for closing costs on a pre-construction condo to be safe (this includes taxes, fees, adjustments, etc., minus any first-time buyer rebates). The good news for first-timers is that programs like the land transfer tax rebate and HST rebate can significantly reduce the cash needed at closing.

Read: Everything You Should Know about Interim Occupancy in Canada

FAQ: Financial Aspects of Pre-Construction

- Q: How much deposit do I need for a pre-construction condo in Ontario?

A: Typically around 15–20% of the purchase price in total. Builders often structure this in installments (e.g., 5% in 30 days, 5% in 90 days, etc.) so you don’t pay it all at oncereddit.com. For instance, a $600,000 condo might require about $90,000–$120,000 in deposits spread over the construction period. This deposit becomes part of your down payment at closing. - Q: What’s the difference between a deposit and a down payment?

A: The deposit on a pre-construction condo is the money you pay the builder upfront in stages to secure your unit – essentially a form of down payment paid early. The down payment is the total amount of your own money you’re putting into the home (vs. the mortgage). In a resale, you typically pay the down payment to the seller at closing (aside from a small initial deposit with your offer). In a pre-con purchase, you’ve paid most of your down payment as deposits by the time you close. - Q: Do I have to pay HST on a new condo purchase?

A: Yes, new construction homes are subject to HST, but if you’re buying as an end-user (planning to live there), the sticker price usually already includes the HST after the new-home rebate. You won’t need to come up with extra HST at closing because the builder claims the rebate on your behalftaxtron.ca. If you’re not moving in (say you plan to rent it out), you would need to pay the HST on closing (which can be tens of thousands of dollars) and later apply for an HST rebate for rental properties. Always clarify with the builder whether the purchase price is inclusive of the HST and rebates.

What Buyers Need to Consider Before Signing

Before you sign on the dotted line for that pre-construction condo, make sure you’ve done your homework. Buying a home that doesn’t exist yet (on paper and plans) carries unique considerations. This section will highlight what you need to think about – from the contract conditions to the builder’s reputation – before you commit to a pre-con deal as a first-time buyer.

Cooling-Off Period and Contract Review

Ontario gives condo buyers a valuable safety net: a 10-day cooling-off periodinstagram.com. This means after you sign a purchase agreement for a new condo, you have 10 calendar days to reconsider your decision without penalty. During this time, you should absolutely get the agreement reviewed by a lawyer who is experienced in pre-construction contracts. These contracts are lengthy and filled with clauses about things like closing dates, development charges, condo rules, etc. A lawyer will help you understand your obligations and rights, and can negotiate amendments (for example, capping those extra fees we mentioned). If you find something you’re not comfortable with or if your financing doesn’t come through, you can cancel the purchase within those 10 days and get your deposit fully refundedinstagram.com – no questions asked.

Read: Understanding the Pre-Construction Agreement of Purchase and Sale

Tips before signing:

- Use the 10 Days Wisely: Don’t just cool off – investigate. Secure a mortgage pre-approval if you haven’t already, get that legal review, and ask questions. If anything major comes up (unexpected costs, or you realize the commitment is too much), you can back out in this period.

- Conditional Offers: Note that outside of this statutory rescission period, builders typically do not allow other conditions (like conditional on financing or the sale of your current home). When you sign a pre-construction contract, it’s firm after the 10 days. So be sure about your decision and finances by day 10.

Builder Reputation and Project Details

Not all builders are equal. As a first-time buyer, you might be less familiar with developers, but it’s worth doing some research on the builder’s reputation and the specific project:

- Builder Track Record: Look up the developer’s history. Have they completed projects in the past successfully and roughly on schedule? Do those buildings have good quality reviews from owners? In Ontario, you can check the builder’s standing with Tarion (the warranty provider) – Tarion’s website lists if a builder is licensed and if there are any past issues or claims. A reputable builder means a lower risk of project cancellations or major delays.

- Project Timeline: Understand the expected timeline for construction and closing. The contract will have an Occupancy Date or closing date, but almost all projects get some delays. Ontario’s new home contracts come with a Tarion Addendum outlining critical dates and what compensation or rights you have if delays go beyond a certain point. It’s common for condo projects to be delayed by a few months (or more in large projects). Be mentally and financially prepared for the move-in date to possibly shift. If the project is significantly delayed beyond a certain threshold (outlined in your contract), you may have the right to cancel and get your deposit back – but most first-timers prefer to stick it out and get their home, since prices may have risen since they bought.

- Amenities, Fees, and Rules: Before signing, consider what the condo offers and what the monthly condo maintenance fees might be when it’s completed (the developer’s disclosure statement will have an estimate). Also note any restrictions (for example, some condos might have rules against Airbnb, or have expensive amenity upkeep that could drive future fees). As an end-user, you’ll want a building that suits your lifestyle long-term.

- Unit Details: Scrutinize the floor plan and specification sheet. What finishes and appliances are included? What costs extra (upgrades or parking/locker)? Make sure the unit size and any balcony or terrace is clearly listed. Small details, like the location of columns or ceiling heights, can affect your enjoyment of the space. Remember, you’re buying from a plan – so ask the sales rep about anything you don’t understand on the drawings.

Risks and Protections

Buying pre-construction comes with a few risks that you should weigh and try to mitigate:

- Financial Risk: The market could change by the time the condo is built. While many pre-construction buyers have benefited from price appreciation by closing, it’s possible (though historically rarer) that prices stagnate or drop. If at closing the unit’s appraised value is lower than what you paid, your lender might only finance based on the lower value, meaning you’d have to cover any shortfall. This is another reason to not stretch to the absolute maximum budget.

- Interest Rate Risk: We’ll dive more into mortgages next, but note that if interest rates rise significantly by the time you need a mortgage, your cost of owning will go up compared to when you signed. Think about your future monthly affordability – stress test your own budget at higher rates to be safe.

- Project Cancellation: In rare cases, a condo project can get cancelled (usually if the builder can’t secure financing or approvals). If that happens, you are entitled to get your deposit money back (it’s held in trust). You won’t, however, get compensation for the lost time or opportunity. While you can’t control this, choosing a builder with a solid history and projects that are mostly sold out can reduce this risk.

- Warranty Coverage: The Tarion new home warranty will cover your condo for defects (e.g., 1-year general workmanship, 2-year for mechanical systems/water penetration, 7-year for structural issues). It also provides deposit protection (as noted, up to $20k for condos)facebook.com. Be sure to file any warranty claims within the deadlines after you move in – it’s your right as a new homeowner.

Read: What to Do if Your Pre-Construction Condo Project Gets Delayed or Cancelled

FAQ: Before Signing a Pre-Con Contract

- Q: What is the 10-day cooling-off period in Ontario?

A: It’s a 10 calendar day window after signing a purchase agreement for a new condo during which you can cancel for any reason without penaltyinstagram.com. This period is mandated by Ontario law. It allows you to do due diligence (get legal advice, arrange financing) and change your mind if needed. If you do back out within these 10 days, you get your full deposit backinstagram.com. (Note: This cooling-off rule applies to new condominium purchases. For newly built freehold homes, there isn’t a legislated cooling-off period, so you have less flexibility if buying a pre-construction freehold house.) - Q: How can I verify a builder’s reputation?

A: Start by checking if the builder is registered with Tarion (Ontario’s new home warranty program) – Tarion’s online directory will show their status and any past warnings or revocations. You can also research news articles, forums, or ask real estate agents about the builder. Look at the builder’s previous communities: Are past buyers generally satisfied? Did the condos have major issues? A bit of homework upfront can save you from unreliable builders. - Q: What if I need to back out after the 10-day period?

A: Once the cooling-off period has passed and the deal is firm, it’s difficult and costly to back out. If you simply walk away, you will likely forfeit your deposit and could face legal action from the builder. The only “outs” after that are specific contract provisions – for example, if the builder fails to meet the project obligations (such as extreme delays that trigger your right to cancel as per the Tarion Addendum). But those situations are uncommon. Essentially, after day 10 you should proceed with the intent to close on the unit, so be sure before that deadline that you’re committed.

Mortgage Approval Process for First-Time Buyers

Navigating the mortgage process for a pre-construction condo is a bit different from an immediate resale purchase. As a first-time homebuyer, getting your financing lined up is crucial – both at the time you sign the purchase agreement and when the condo is ready to close. Here’s what you need to know about mortgage approvals for pre-construction:

Mortgage Pre-Approval: Your First Step

Before (or very soon after) you sign a contract, you’ll want to get a mortgage pre-approval. A pre-approval is essentially a lender’s assessment of how much they’re willing to lend you, based on your income, debts, and credit score. The lender will also qualify you under the federal mortgage stress test – meaning they ensure you can afford payments at a simulated higher interest rate (usually about 2% above the current rate). This is to prevent borrowers from overextending. Getting pre-approved gives you a clear budget and confidence that you can secure a mortgage up to a certain amount.

Key points about pre-approvals for pre-construction:

- Validity Period: Most mortgage pre-approvals come with an interest rate hold for ~90 to 120 days. Since your pre-construction condo might not close for 2-4 years, that rate hold will expire long before you need the mortgage. Essentially, the pre-approval for a pre-con purchase is for planning purposes only – it’s not a guarantee of the future loan, but it’s still important. It tells you (and the builder) that you’re qualified today for the purchase price. Some builders even require proof of pre-approval or a mortgage letter within the 10-day period to ensure you’re a serious buyer.

- Amount and Down Payment: The pre-approval will consider how much down payment you intend to put. If you’re only putting the minimum (e.g., 5-10%), the lender will factor in the added mortgage insurance premium into your affordability. Remember, if your down payment ends up below 20%, your mortgage will be a high-ratio mortgage that requires CMHC/Sagen insurance (with a premium that can be 4% of the loan for 5% down, for example). This premium is usually added to your mortgage amount. Ensure you’re comfortable with the mortgage payments including that insurance.

It’s wise not to max out the price on your pre-approval. Leave some breathing room for future interest rate increases or other expenses. Also, avoid taking on new debt (like car loans or large credit lines) after you’re pre-approved – it could lower the amount the bank will lend later.

Final Mortgage Approval and Closing

The true mortgage approval that matters will happen closer to your condo’s completion. Typically, a few months before the condo’s occupancy or closing date, you’ll formally apply to your lender to convert your pre-approval into a live mortgage approval for the specific property.

Here’s what to expect:

- Update the Paperwork: The lender will re-check your financial situation. You’ll need to provide up-to-date income proof (employment letter, pay stubs or tax returns if self-employed), credit will be re-pulled, and you’ll show proof of the deposit funds you’ve paid and any additional down payment you’ll be making. Essentially, you must still qualify under the lender’s guidelines at that time. If your income has gone up since signing, great – if it’s gone down or you incurred new debts, that could be an issue.

- Appraisal: The lender might require an appraisal of the condo once it’s near completion, to verify the market value. In many cases, if the market has risen, the appraisal will come in at or above your purchase price (which only helps your case). If the market has declined, there is a risk the appraisal is lower than what you agreed to pay. As mentioned, if that happens, the bank may base the mortgage on the lower value – meaning you would have to increase your down payment to cover the difference. This scenario is not common for long-term market trends, but be aware of the possibility.

- Interest Rate: The interest rate for your actual mortgage will be whatever is available at the time of closing. If rates have gone up since you signed the contract, unfortunately you don’t get the old rate from years ago (unless you made a special long-term rate lock arrangement). However, some lenders offer a “builder rate hold” or extended rate guarantee for new construction buyers – it’s something you can inquire about, though these often come with a slightly higher rate or fees. Regardless, about 60-120 days before closing, start shopping around for the best rates or speak to a mortgage broker to secure a rate for your upcoming mortgage.

- Insurance and Taxes: As a first-time buyer, remember to account for property taxes and home insurance which you’ll start paying after closing. Lenders will factor property taxes into your debt service ratios. Condo buyers should also note the monthly condo fee when qualifying – lenders typically include 50% of the condo fee in your affordability calculationlinkedin.com (because a portion goes to building maintenance). Make sure the projected condo fee in your purchase agreement isn’t so high that it hampers your mortgage approval.

Maintaining Financial Health

From the time you sign the purchase to the time you close (which could be years), it’s crucial to maintain your financial health:

- Stable Income: Try to avoid gaps in employment or switching to a lower-paying job right before closing. Lenders like to see stability. If you do change jobs, be prepared to provide additional proof of income or probation status.

- Credit Score: Keep paying your bills on time and don’t max out credit cards. Avoid taking on new loans or financing. A new car loan or too much debt could reduce the mortgage amount you qualify for, or worst case, lead a lender to reject your application.

- Save More if Possible: If you continue saving during the construction period, you could choose to increase your down payment at closing. For example, maybe the builder only required 15% in deposits but by closing you’ve saved up another 5%. If you add that, you can avoid mortgage insurance (at 20% down) and enjoy smaller monthly payments. It’s not required, but it’s a good goal if you have the means.

- Document Any Gifts Early: If a family member plans to gift you money for the down payment at closing, discuss it with your mortgage advisor in advance. Gifted down payments are common for first-time buyers, but the lender will want a gift letter, and the funds should be in your account well before closing.

Overall, the key is not to assume the mortgage is a done deal until it’s funded. Keep your finances as steady as possible and stay in touch with your lender or broker as the closing approaches.

FAQ: Mortgages for Pre-Construction

- Q: Do I need a mortgage pre-approval to buy a pre-construction condo?

A: It’s highly recommended. While a pre-approval isn’t legally required to sign a purchase agreement, many builders want to see that you’ve been pre-approved for a mortgage. More importantly, it confirms how much you can afford. A pre-approval will estimate your maximum purchase price and lock in an interest rate for up to 120 days (useful if the condo is completing soon). Even though the final mortgage will be approved later, a pre-approval gives you confidence going in that you’ll be able to get a mortgage when the time comes. - Q: How long before closing should I get my actual mortgage approval?

A: Usually about 60-120 days before closing you should start the formal mortgage approval process. For example, if your builder notifies you that occupancy is expected in September, you’d talk to your lender in the spring or early summer to get the ball rolling. Lenders often underwrite the mortgage and can give a firm approval a few weeks before closing, contingent on final documents. It’s a good idea to secure a rate around this time too, in case rates change. - Q: What if interest rates rise before I close – could I fail to get the mortgage?

A: If interest rates go up a lot, it could affect your mortgage affordability because of the stress test. Let’s say you were stretching your budget at a 4% rate; if rates are 6% at closing, the bank will be qualifying you at ~8% (6% + buffer). That means you might qualify for a smaller loan than anticipated. To avoid surprises, aim to leave a cushion in your budget. If you were pre-approved at the edge of your limit, consider saving extra or reducing other debts to improve your position. Typically, if you maintain good credit/income and the price of the condo hasn’t changed, you should still get the mortgage – you might just pay a higher interest cost than expected. In some cases, you can pay to extend a rate hold or use a rate cap program for peace of mind, but these can be pricey. Most first-time buyers simply prepare for a potential rate difference and budget accordingly.

Government Tax Credits and Incentives for First-Time Buyers

Buying your first home in Ontario comes with some government support! There are several programs, rebates, and tax incentives designed to lighten the financial load for first-time homebuyers. Make sure you take advantage of these, as they can collectively save you tens of thousands of dollars. Below, we cover the key federal and provincial incentives available in 2024–2025.

Tax Credits and Savings Programs (Federal)

- First-Time Home Buyers’ Tax Credit (HBTC): When you purchase your first home, the federal government offers a non-refundable tax credit to help with closing costs. The amount you can claim on your income tax is $10,000 (called the Home Buyer’s Amount), which results in a rebate of $1,500 on your taxes for the year of purchasewowa.ca. You claim this when you file your tax return (there’s a specific line for the Home Buyer’s Amount). If you have a spouse who is also a first-time buyer, you can split the claim, but the maximum combined is still $10k claimed ($1,500 back). Tip: Ensure you meet the criteria (neither of you owned a home in the past four years, etc.) – it’s usually straightforward for true first-timers.

- Home Buyers’ Plan (HBP): This program lets you withdraw funds from your RRSP (Registered Retirement Savings Plan) to use as a down payment without immediate tax. You can withdraw up to $35,000 per person (${70,000} per couple) from your RRSPrbcwealthmanagement.com. The catch is you have to repay it over 15 years, starting a couple of years after the withdrawal, by making annual contributions back to your RRSP. It’s essentially an interest-free loan to yourself. If you don’t repay in a given year, that year’s payment amount is added to your taxable income. The HBP is great if you’ve been diligently saving in RRSPs for a house – it boosts your down payment. Just remember to budget the repayment in future years.

- First Home Savings Account (FHSA): New in 2023, the FHSA is a fantastic tool for first-time buyers. It’s like a hybrid of an RRSP and TFSA specifically for home buying. You can contribute up to $8,000 per year, to a lifetime maximum of $40,000rbcwealthmanagement.com. Contributions are tax-deductible (like an RRSP), and withdrawals (including growth) are tax-free if used to purchase your first home (like a TFSA). You can carry forward unused contribution room (up to $8k carry-forward). For example, if you only contributed $5,000 this year, next year you could contribute $8,000 + $3,000 carryover = $11,000rbcwealthmanagement.com. If you’re planning ahead for a first home, an FHSA is a powerful way to save because you get a tax refund on contributions and you don’t have to repay the withdrawal. One person can save $40k, and if you’re a couple and both qualify, that’s $80k total (plus whatever investment growth on top). Note that you must be a first-time buyer (no home ownership in last 4 years) and a Canadian resident over 18 to open an FHSA. The account can stay open for 15 years or until end of the year you turn 71, if you don’t buy a home by then you can transfer the savings to an RRSP. Bottom line: if you’re in saving mode, use the FHSA first for a down payment, and supplement with HBP/RRSP if needed – you can even combine FHSA and HBP for the same home purchaserbcwealthmanagement.com.

- First-Time Home Buyer Incentive (FTHBI): This was a federal program introduced in 2019 that offered 5% or 10% of the home’s price as a shared-equity loan (interest-free) to help reduce mortgage payments. However, as of March 2024 the FTHBI program has been discontinuedwowa.ca due to low uptake. Applications had to be in by March 31, 2024. If you’ve heard of it, note that it’s no longer available going forward. The government may introduce new measures, but for now, plan on the other programs instead.

Land Transfer Tax Rebates and Other Ontario Incentives (Provincial/Municipal)

- Ontario Land Transfer Tax (LTT) Rebate: As mentioned earlier, Ontario offers first-time homebuyers a rebate on the provincial land transfer tax up to $4,000wowa.ca. Practically, this means if your home costs ~$368k or less, you pay no Ontario land tax; above that, you save the full $4k and pay the remainderwowa.ca. The title of the home must be in the name of a first-time buyer (if you have a co-owner who is not a first-timer, you get a proportional share of the rebate). The rebate is usually applied directly at closing by your lawyer so you need less cash at close.

- Toronto Land Transfer Tax Rebate: Buying in the City of Toronto? There’s a municipal LTT on top of the provincial. Luckily, Toronto also provides a first-time buyer rebate up to $4,475 on the city taxwowa.ca. Just like the provincial one, your lawyer will apply for it at closing. Combined, an eligible first-time purchaser in Toronto can get up to $8,475 total in land tax rebates (max $4k Ontario + $4,475 Toronto)wowa.ca. This is a big help given Toronto’s high home prices.

- Housing Affordability Programs: While the big programs are above, keep an eye out for smaller programs that come and go. For example, some cities or employers have partnership programs or grants for first-time buyers (these are often geared to lower-income households). At the time of writing, Ontario doesn’t have a standalone first-time buyer grant beyond the LTT rebate, but it’s worth checking your city or region for any home ownership assistance programs (occasionally there are down payment assistance loans for moderate-income buyers).

- GST/HST New Housing Rebate: This bears repeating under incentives – the HST rebate on new homes is a government program that significantly reduces the effective tax on your home purchase. Although not limited to first-timers, if you are a first-time buyer purchasing a pre-construction condo to live in, you will benefit. The federal portion of the HST on new homes has a rebate for homes up to a certain value, and Ontario’s provincial portion rebates 75% of the provincial HST up to $24ktaxtron.ca. The result is that the sticker price from the builder has already factored in a savings (the builder credits the rebate). If it weren’t for this rebate, buying a new $500k condo would cost you $24k more! Consider this an incentive that is “built-in” to new home pricing – just be aware of it.

Finally, remember that as a first-time buyer you are exempt from Ontario’s foreign buyer tax (the Non-Resident Speculation Tax), as long as you’re a Canadian citizen or permanent resident. This isn’t so much an incentive as it is a bullet dodged (foreign buyers pay 25% extra tax on purchases in Ontario, but local first-timers don’t need to worry about that).

FAQ: First-Time Buyer Incentives

- Q: How do I claim the $1,500 First-Time Home Buyers’ Tax Credit?

A: You claim it when filing your income tax return for the year you bought your home. Look for the “Home Buyer’s Amount” on your federal tax schedule. You can enter $10,000 (if you’re the buyer) which will equate to $1,500 off your taxes payablewowa.ca. If you and your partner both qualify and bought the home together, you can split the $10k (e.g., $5k each) or one of you can claim the full amount – but you cannot exceed $10k total for a single home purchase. It’s a one-time credit (first year only). - Q: What is the process to get the land transfer tax rebate in Ontario?

A: There’s no separate form you usually need to fill out as the homebuyer – your real estate lawyer will apply the rebate directly when they calculate the land transfer tax for your closing. Essentially, at closing, the lawyer confirms you’re a first-time buyer (they’ll have you sign an affidavit confirming you haven’t owned a home before, etc.) and then deducts up to $4,000 from the Ontario land transfer tax amount (and up to $4,475 from Toronto’s, if applicable)wowa.ca. The final amount is paid to the government, and you see the savings instantly in your closing costs. It’s important that all people on title are first-time buyers to get the full rebate. If only one of two buyers is first-time, you’d get half of the rebate. - Q: Can I use both the RRSP Home Buyers’ Plan and the FHSA for the same home?

A: Yes! These two programs can be used together. For example, you could withdraw $35,000 from your RRSP under the HBP and also pull money from your FHSA (up to $40k plus growth) for the same home purchaserbcwealthmanagement.com. This is a great way to boost your down payment. Just remember that the RRSP withdrawal has to be paid back over time, whereas the FHSA withdrawal does not. Always use the FHSA first if you have one, since it’s free money essentially (tax-free out, no payback). The HBP is useful if you need additional funds on top of that. - Q: Are there any incentives exclusive to new construction homes?

A: Apart from the HST rebate (which we discussed) and Tarion warranty coverage, most incentives apply whether you buy new or resale. One thing to note: some developers offer limited-time perks to attract first-time buyers – for example, they might throw in free upgrades, a discount on parking, or extended deposit schedules (like 5% per year). These aren’t government programs, just builder promotions. It never hurts to ask the sales office if they have any first-time buyer incentives or credits available. And of course, as a first-time buyer, you’re getting a brand new, never-lived-in home with a warranty – that in itself is an advantage that comes with new construction.

Build Your Expert Team

In important financial moves, having the right people in your corner means lower risk and fewer surprises down the road. A strong team of experienced experts helps you avoid costly mistakes, understand what you’re signing, and make informed decisions every step of the way.

Here’s who you’ll want by your side:

A Pre-Construction Realtor

Not all realtors specialize in pre-construction, and here experience matters. A knowledgeable pre-construction realtor will:

- Give you access to VIP pricing and exclusive incentives

- Help you understand floor plans, layouts, and developer offerings

- Walk you through the process from your first worksheet to final closing

- Offer advice about what projects are worth your time and money

They’ll also help you time your purchase right, often before units are released to the public, which can make a big difference in price and selection.

A Real Estate Lawyer

Buying a first new condo involves signing an agreement, which is typically long and full of jargon, written in legal language. And if you don’t speak legal, you need someone who does. Yes, a real estate lawyer. Adding an expert in real estate (and ideally, pre-construction) is crucial, as they will help you:

- Review the Agreement of Purchase and Sale (APS)

- Identify any extra fees, restrictions, or tricky clauses

- Explain development charges, adjustments, and your rights if a project is delayed or cancelled

Think of your lawyer as your safety net — they’ll make sure you know exactly what you’re signing.

Research and Choose Developers and Projects

Choosing a developer is like choosing a partner when starting a relationship; knowing the background and key details is essential. Not all developers operate similarly, so before committing to a unit, do your homework. Make sure the project and the team behind it align with your expectations and long-term goals.

Here’s what to focus on:

Check the Developer’s Reputation

Look at the builder’s track record. Have they completed other projects? Were they delivered on time? Are the owners happy with their homes?

- Look them up on the Ontario Builder Directory

- Read Google reviews and buyer forums

- Visit completed buildings if possible

A reputable developer is more likely to deliver on time and with fewer surprises.

Study the Floor Plans & Features

Pre-construction units vary a lot in terms of layout and design. Look at how the space is used, especially in smaller units. Ask yourself:

- Are there awkward corners or wasted space?

- Is there enough storage?

- What finishes and appliances are included?

Your realtor can help you interpret floor plans and flag things you might miss.

Evaluate Location & Long-Term Potential

At the end of the day, it all comes down to location. This one factor has a big impact on both resale value and quality of life. Consider:

- Nearby transit, schools, and shopping

- Planned future development in the area

- The neighbourhood’s long-term growth potential

Also, check out the building’s amenities, things like fitness centres, co-working lounges, or outdoor terraces can boost the appeal and future value of your unit down the line.

Once you’ve found a project you like, it’s time to act!

Submit a Worksheet

Once you’ve found a pre-construction condo that checks all your boxes, take the first official step: submit a worksheet. Is it the contract? No, it’s more like raising a hand to say, “I’m interested!”

What’s a Worksheet?

It is a form that is completed with your personal information and your top 3 to 5 unit choices (floor, layout, view, etc). Developers use the worksheet to gauge interest and assign units accordingly, especially during early or VIP sales.

- It’s not legally binding

- No money is exchanged

- Submitting early boosts your chances of getting what you want

Timing Is Everything

Pre-construction units are often released in phases. The best ones (think best views, floor plans, prices,…) go first, so the sooner you submit your worksheet, the better.

Your realtor will guide you through filling out the form, making choices, and staying informed as allocations are made. If you get a unit, you’ll move on to the next big step: signing the Agreement of Purchase and Sale (APS).

Sign the Agreement of Purchase and Sale (APS)

Now, after your worksheet is approved, it’s time to make things official by signing the Agreement of Purchase and Sale (APS). This is the contract, the document that has everything about your purchase, from the price and timeline to what happens if things change. The core of the purchase! What does this APS include?

- Purchase Price: Agreed unit cost at time of signing

- Deposit Schedule: Breakdown of deposit amounts and timelines (e.g., 5% at signing, 5% in 90 days)

- Tentative Occupancy Date: Estimated move-in timeframe (subject to change)

- Closing Costs: Final charges, development levies, HST (if applicable), legal fees, adjustments

It’s a lengthy contract full of jargon and industry terms, but worry not, you have a real estate lawyer on your team!

Before You Sign:

- Take your time. You’re not rushed into anything.

- Make sure your lawyer has reviewed every clause, especially around delays, cancellation policies, and extra charges.

The good news? In Ontario, you’ve got a safety net in place: the 10-day cooling-off period.

The 10-Day Cooling-Off Period

Once you sign the APS, you get a 10-day cooling-off period. The purpose? It works just like pressing Ctrl + Z on your keyboard. During this time, you have the chance to step back, review everything with a clear head, think twice, and make sure this is truly what you want, no strings attached. In plain English, you have 10 calendar days (not business days) to:

- Re-review the agreement with your real estate lawyer or other experts

- Confirm your financing is in place

- Ask questions, raise concerns, or even walk away and still get your full deposit back

What to Do During This Time

- Lawyer Review: Development charges, fee caps, cancellation clauses, builder obligations

- Hidden Fees Check: Utility setup charges, high closing adjustments, and unexpected costs

- Comfort Level Check: Fine print reviewed, numbers aligned with budget and expectations

This period exists to protect you; use it wisely, ask questions, and take your time. If everything checks out, congrats, you’re officially on your way to becoming a homeowner.

Stay Informed During Construction

Playing the long game is what you do when buying pre-construction. Your condo won’t be ready right away. Does that mean sitting back and waiting? No. Staying informed throughout the whole construction phase helps you avoid surprises, feel confident, and prepare for each milestone.

Stay in Touch with Your Agent & Developer

You’ll receive updates from the developer or your pre-construction realtor, keeping you informed about major changes. Here’s what to watch for:

- Construction progress reports

- Occupancy date changes (these can shift, sometimes more than once)

- Requests for additional documents or deposits

Don’t hesitate to ask questions along the way. Understanding what’s happening behind the scenes can give you peace of mind.

Join Buyer Groups or Forums

Joining online communities or group chats is a wise move because it keeps you updated and informed. These spaces are great for:

- Comparing notes on updates

- Sharing tips on upgrades, finishes, and move-in prep

- Building a sense of community before move-in day

It’s a helpful way to stay connected, and sometimes, you’ll learn about things before official notices go out.

Understanding Interim and Final Occupancy

Interim Occupancy and Final Closing are the last steps before officially becoming a homeowner. Each one is a big milestone.

What is Interim Occupancy?

Once your unit is physically ready, of course, you can move in, but you’re not still the owner; at this time, you’ll enter the Interim Occupancy phase. Technically, you’re now renting it from the developer. For how long? Until the building is officially registered.

Key things to know:

- Occupancy Fees: You’ll start paying occupancy fees. And not your mortgage yet. These typically cover things like property taxes, maintenance, utilities, & other operational costs.

- Remaining Deposits: You may also be asked to pay any remaining deposit amounts before moving in.

Pro tip: Meet with your lawyer to go over these final steps.

Final Closing

The Final Closing, as the name suggests, is the last step, when the building is officially registered with the city, and the ownership officially transfers to you. You’ll be paying your mortgage and any final closing costs at this stage.

What to expect:

- Transfer of Ownership: Your lawyer will finalize all paperwork, and you’ll officially own your unit.

- Mortgage Activation: This is when your mortgage kicks in, and your monthly mortgage payments start.

- Final Costs: You’ll pay any remaining closing costs, such as legal fees, land transfer tax, and adjustments (like utility bill differences or changes to the final price).

Common Mistakes to Avoid

In our years of experience working with plenty of first-time homebuyers, we’ve noticed that they tend to make similar mistakes. Here are the most frequent ones:

- Not Reviewing the APS with a Lawyer: This is the core of your purchase, a legally binding contract, and it’s crucial to have a real estate lawyer go over it with a fine-tooth comb.

- Waiting Until Public Launch Instead of Using VIP Access: VIP buyers typically get first pick of the units, which means: better locations and layouts at lower prices. By waiting until the public launch, you risk paying more and losing out on your preferred units.

- Underestimating Closing Costs & Development Charges: The cost of buying pre-construction isn’t just the price of the unit. There are additional fees that can surprise first-time buyers:

- Choosing the Wrong Unit Based Only on Price: Buying the cheapest unit is tempting sometimes, but remember that location, floor plan, and future resale value are just as important.

- Ignoring Neighbourhood Development Plans: It’s easy to focus on the condo itself, but don’t overlook the broader neighbourhood.

Bottom Line

Buying your first pre-construction condo can be incredibly rewarding—or not. What makes the difference between a smart investment with high ROI and a costly misstep is preparation, knowledge, and the right guidance. Success lies in understanding each step, planning your finances carefully, and partnering with experienced professionals.

Whether you’re looking for the best deals, insider pricing, or expert guidance through every step of the process, Platinum Condo Deals is here to help. Reach out to us today to get exclusive access to VIP pricing, the latest project updates, and personalized advice tailored to your needs. Let’s make your dream home a reality!

Jatin Gill, an esteemed authority in real estate writing, is celebrated globally for his unparalleled expertise. With over 20 years in the industry, he has authored more than 1,000 SEO-friendly articles covering every facet of real estate. Specializing in pre-construction projects, Jatin's extensive knowledge spans all real estate topics. His content is a go-to resource for anyone seeking comprehensive, insightful, and up-to-date information in the real estate market.

Learn MoreFAQs

A pre-construction condo is a unit purchased before it’s built. You choose your unit from floor plans, and once completed, you move in, benefiting from future price appreciation.

Typically, pre-construction condos take 2 to 5 years to complete, but timelines can vary depending on the project and developer. Delays can happen, so staying updated is key.

In addition to the purchase price, expect to pay deposits, closing costs, legal fees, and development charges. You’ll also pay occupancy fees before final closing, which covers maintenance and taxes.

You can sell before completion, but there may be restrictions or fees. You’ll need developer approval and may only sell once the unit is registered. Always check your agreement.

In Ontario, the cooling-off period is 10 days after signing the agreement. It allows you to review the contract, confirm financing, and back out without penalty if necessary.

Additional Resources

Awards & Achievement

Subscribe for the Latest Condo Deals

Apologies, our subscription list for this month is now full. Please register on our website to secure your spot for next month. Thank you for your interest!